Problems With Bars in Family Restaurant Near Me

Zachary Davis, owner of The Glass Jar restaurant group in Santa Cruz, Calif., said he intentionally avoided working with nutrient-delivery apps before the COVID-19 pandemic considering the costs to his business organisation but seemed too high.

But when his county issued shelter-in-place orders, "we were effectively close down. Nosotros closed for a couple of days, took stock and realized it was the merely mode to keep our business organisation open," he told MarketWatch.

Davis is not alone. Delivery apps take become more than of import for both business owners and their customers as more than people order takeout and groceries during the coronavirus pandemic. DoorDash Inc.'s DASH recent filing for an initial public offering and earnings reports from Uber Technologies Inc. UBER,

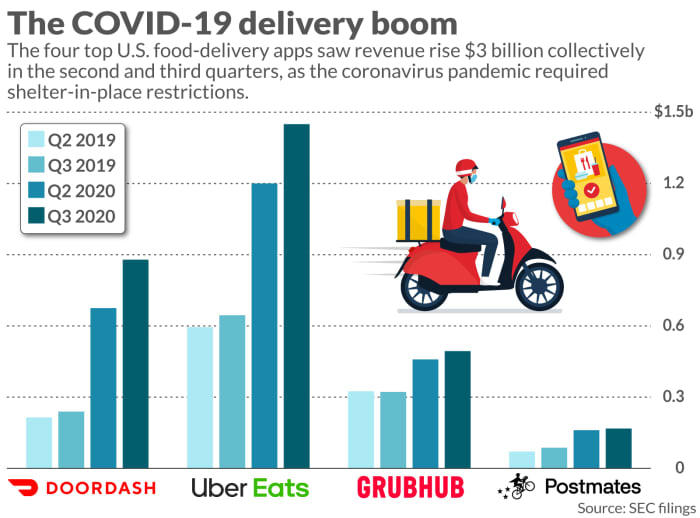

The iv companies raked in roughly $5.five billion in combined revenue from April through September, more than twice every bit much every bit their combined $2.v billion in acquirement during the aforementioned period terminal year.

Nevertheless unclear is how long the surge in deliveries will last, though, and what it means to the fiscal success — or lack thereof — of food-delivery apps in the long run. While the companies are seeing a surge in business concern, their costs remain as well high to post any sustained profit. And the other stakeholders involved, such as the restaurants, drivers and cities, are looking to either cap the fees the companies are allowed to charge or to get their off-white share of the companies' revenues.

In the short term, many restaurants take fiddling choice but to sign on with the apps. A Cowen & Co. survey of ii,500 consumers showed that in July, 52% said they would avoid restaurants and bars even after they fully reopen, and a recent rise in COVID-19 cases nationwide means many restaurants are over again facing onsite-dining restrictions. Co-ordinate to eatery-reservation platform OpenTable, the number of seated diners in the U.Southward. decreased an average of 52% the week of Nov. 19-23.

"Restaurants are heading into a terrifying wintertime with no lifelines other than delivery platforms," MKM Partners analysts reported concluding week.

That is probable to benefit DoorDash, the U.South. industry leader with 50% market share, and the next biggest players: a combined Uber Eats and Postmates, then Grubhub, according to Edison Trends. DoorDash said in its prospectus that its 543 million total orders for the get-go ix months of the year tripled compared with 181 one thousand thousand orders in the year-ago period.

See: DoorDash IPO: v things to know about the app-based food-commitment company

Uber Chief Executive Dara Khosrowshahi was and then bullish on commitment that during the visitor's 2nd-quarter earnings call, he likened Uber Eats to "another Uber" that the company essentially "built in under three years." That quarter, Uber Eats brought in more than revenue than rides for the first time.

In the tertiary quarter, Uber's delivery business organization continued its growth: Uber Eats' bookings rose 135% year over year, and its revenue surged 125% to $1.45 billion. Uber's buy of Postmates, which is expected to close in the fourth quarter of 2020, will bolster its delivery concern.

For more: The pandemic turned Postmates' IPO plans into a bidding war between Uber and Wall Street

Chicago-based Grubhub, which is being caused past Just Eat Takeaway TKWY,

Beyond takeout, Uber and DoorDash are doubling downwards on commitment on multiple fronts, increasingly competing with Amazon Inc. AMZN,

The companies are likewise competing with Instacart, some other gig company that delivers groceries. DoorDash recently introduced DashMart, its foray into convenience-store delivery. It has become the official on-need delivery app of the NBA and brought on more grocery-store partners. Citing growing consumer demand, Uber in the 2nd quarter launched delivery of groceries and goods from convenience stores and pharmacies.

It's up in the air whether the demand and new offerings will translate into profit. The companies are all largely unprofitable: DoorDash turned a $23 million profit in its second quarter, but information technology nevertheless lost $149 1000000 through the first nine months of this year, co-ordinate to its prospectus.

"The profitability of the 3rd-party delivery manufacture withal remains a lingering question, with no perspectives offered on when this would be accomplished," Cowen analysts wrote in a research study.

DoorDash said it has lost coin in every yr of its existence, and expects that to keep. Uber reported that its delivery business organization lost an adjusted $183 million in the third quarter, an comeback from the $316 million it lost in the year-ago period. Grubhub lost $9.2 million in the third quarter, compared with a $ane million profit in the same menstruation last year.

Some experts believe DoorDash may have an edge on Uber Eats in the race for profitability. James Gellert, chief executive of Rapid Ratings, a company that assesses the finances of individual and public companies, points to DoorDash's "significantly better" margins. He said DoorDash's fiscal health is amidst the all-time Rapid Ratings has seen amongst companies going public "in recent history."

But DoorDash and its competitors continue to face up a variety of issues that volition affect their financial health. They include pushback from restaurateurs like Davis, who decided to come aboard as a last resort because delivery commissions cut into their profit; dissatisfied couriers; and cities that have capped the commissions apps can collect from struggling restaurants during the pandemic.

"The restaurant industry wants to cap committee," said Marker Cohen, director of retail studies at Columbia Business School. "The simply way to kickoff this conundrum is to raise the prices of the food. When all is said and washed, the consumer is going to pay the price."

In Santa Cruz, where Davis has 3 different brands (Penny Ice Creamery, The Picnic Basket and Snap Taco) at v locations, commissions are capped at 15% correct at present. Several other cities' caps range from 10% to twenty% — lower than the usual thirty% that the companies have sought. A recently launched campaign called Protect Our Restaurants is pushing to extend those caps around the nation.

The entrada, led by the American Economic Liberties Project and others, is urging the Federal Trade Commission to investigate the delivery apps' practices.

"A lot of cities are mobilizing on their own to endeavor to save the restaurant manufacture," said Nia Johnson, spokeswoman for the American Economic Liberties Project, in an interview. "What nosotros saw with all these movements was an opportunity to uplift… To really shine a light on the abusive behaviors that are taking place past these corporations."

Delivery apps say they are actually helping restaurants, especially during the pandemic. Taylor Bennett, global head of public affairs for DoorDash, said in an email that the company "has always focused on empowering local businesses," and that "supporting restaurants is more critical than always."

DoorDash says information technology has saved restaurants in the U.South., Canada and Commonwealth of australia at to the lowest degree $120 meg in commission fees during the pandemic, and that its service has kept many restaurants in business concern. Grubhub likewise pointed to the $100 million it says it spent on helping restaurants, drivers and diners from April to June, but would not annotate on the campaign.

Postmates and Uber Eats have not returned requests for annotate on the campaign.

Many couriers who deliver food and other appurtenances for these companies are independent contractors with depression pay and little or no benefits. In California, gig companies successfully passed a ballot initiative this month that will ensure they will not take to treat delivery workers as employees — and they're looking to do the same thing elsewhere.

Read: Uber brands gig companies' efforts to reshape labor laws as 'IC+'

Orlando Santana delivers for Instacart and Amazon Flex in the Seattle expanse, and has also worked for DoorDash and Target Corp. TGT,

But "you kind of but have to have what's at that place," said Santana, a former newspaper employee who now does freelance graphics and photography work forth with deliveries.

Josette Sonceau delivered for DoorDash in Charlotte, N.C., for more than 2 years before she stopped because of wellness issues that could be exacerbated by the pandemic. She said at start, she delivered merely on weekends. When she saw her earnings increment, she started to piece of work weekdays, too, for upwards to 25 hours a week. Then, "around fall concluding year, I began seeing $2 and $3 orders."

Sonceau has lent her vox to a PayUp, a gig-worker campaign, which among other things talks nigh how tipping tin leave depression-paid workers in the lurch. "Changes to the arrangement are long overdue that offer a fair wage for all workers so no 1 must rely on tips," she said.

DoorDash this week reached a $ii.5 meg settlement with the Commune of Columbia over claims it misled customers and skimmed tips intended for its delivery workers between 2017 and 2019. DoorDash has since revised its tip policy.

The labor issues bring legal and regulatory scrutiny — places like San Francisco have sued the companies and the state of California passed a law, which the only-passed ballot initiative will render moot — but they also carp some restaurant owners who use the apps.

"Every bit an employer who cares securely near my staff and who is ever looking for ways to support them, I detect the efforts of the delivery-app companies to push labor costs back onto 'independent contractors' to be distressing," Davis said. He is intrigued by the possibility of teaming up with other restaurant owners to form their own delivery network, simply acknowledges that the reach of the apps and the sophistication of their infrastructures would be hard to replicate.

Even if the gig companies manage to secure their business concern model and avert having to classify their workers as employees everywhere, they will notwithstanding exist adding some labor costs equally they offering compromises that fall short of total employee benefits. They have indicated that they volition laissez passer those costs on to their customers. For example, DoorDash in its prospectus said changes in California could lead it to charge college fees and commissions.

"Everybody who'due south doing well is doing well at someone else's expense," said Cohen from Columbia Concern School.

Source: https://www.marketwatch.com/story/the-pandemic-has-more-than-doubled-americans-use-of-food-delivery-apps-but-that-doesnt-mean-the-companies-are-making-money-11606340169

0 Response to "Problems With Bars in Family Restaurant Near Me"

Post a Comment